8 things to do to give your finances a spring clean

As you start to put winter behind you, you may be thinking of giving your home a spring clean or the projects you want to take on over the next few months. As you do, don’t forget to think about your finances.

Regularly reviewing your finances and plans for the future can help keep you on track. It can provide a chance to find opportunities you may have previously missed to help your assets go further, and ensure the steps you take continue to reflect your plans. Here are eight things to do to give your finances a spring clean.

1. Review your budget

While looking over your budget can seem like a chore, it’s still a worthwhile task. For example, does your budget still reflect your needs and goals? Going through your regular expenses can help you manage your money more effectively.

As well as looking at what money is going in and out of your account, assess if there’s anything you can do to simplify the steps you’re taking. For instance, if you regularly contribute to an ISA, why not set up a standing order? It can minimise the financial tasks you need to do and ensure it doesn’t slip your mind.

2. Organise your paperwork

It’s easy for paperwork to become unorganised. Taking some time to review your paperwork can help ensure you, or others, have access to the information when you need it. Make sure important documents, such as insurance policies, are accessible, and take the opportunity to clear out paperwork that you no longer need.

If your documents are stored or delivered online, make sure you know how to access everything and download important information.

3. Review your pensions

Whether your retirement is years away or you’ve already retired, keeping on top of your pensions is important.

If you’re still paying into a pension, reviewing your contributions and forecasts can help give you an idea of whether you’re on track for the retirement you want, or if you need to take additional steps. Don’t forget about old pensions you may not be paying into, and consider whether consolidation could be beneficial for you.

If you’ve already retired and are using flexi-access drawdown or have a pension you haven’t accessed yet, a review can give you confidence in the future and ensure you have enough for the rest of your life.

4. Check your State Pension entitlement

If you’ve yet to reach State Pension Age, do you know what you’ll be entitled to? To receive the full State Pension, you must have 35 years on your National Insurance record. You should also look at when you will be able to claim the State Pension, as the age is gradually rising and is currently under review. Not being able to claim the State Pension when you expect to, or not being entitled to the full amount could harm your long-term plans.

5. Assess your financial resilience

It’s impossible to predict what will happen in the future. As part of your financial plan, you’ve likely taken steps to create a financial buffer in case something unexpected happens, do these steps still reflect your needs and risks?

Looking at the steps you’ve taken can give you confidence that you’ll be protected and highlight potential gaps. This may include checking your emergency fund and calculating how long it would cover essential outgoings or reviewing if protection policies are still adequate.

6. Check the level of interest your savings are earning

Interest rates are still low, but as the Bank of England increased its base rate, you may be able to make your savings work harder. Switching to an account that offers an initial incentive or a higher rate of interest can give your savings a boost. If you don’t need access to your savings in the short or medium term, locking them away for a defined period could help you secure a better rate of interest too.

7. Review the rate of interest you’re paying for credit

Rising interest rates can mean your savings earn more, but if you still have some form of debt, your regular outgoings could increase too. Creating a plan to pay off debt with a high interest rate can improve your finances over the long term.

It’s also worth looking at transferring your debt to access a better rate of interest. You may be able to transfer existing credit card debt to a different provider that offers an introductory 0% interest rate, for example.

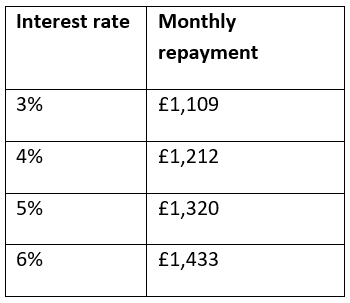

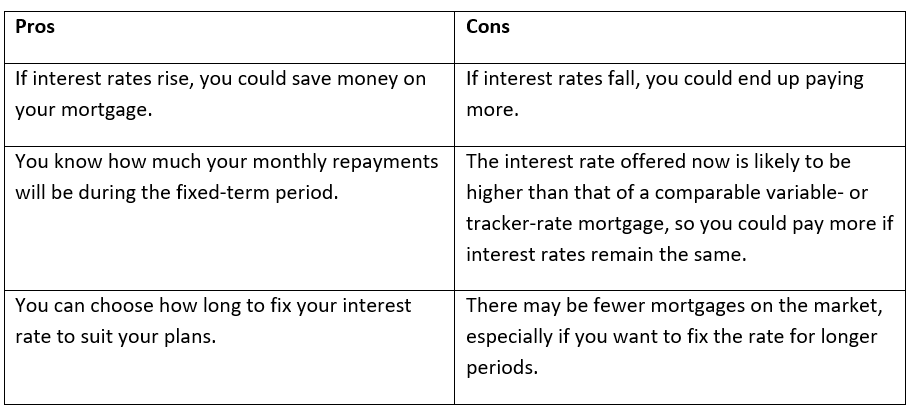

8. Review when your current mortgage deal comes to an end

Finally, if you’re paying off a mortgage, make sure you know when your current deal comes to an end. Once the deal is up, you’ll usually be moved on to the lender’s standard variable rate (SVR), which will typically have a higher rate of interest than alternative deals you could find.

If you need any guidance or would like to review your financial plan, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Not all mortgage contracts are regulated by the Financial Conduct Authority. Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.